Cellebrite DI (NASDAQ:CLBT)

Tier 1 Vertical Market Software Asset Trading at Bargain Prices

Cellebrite Thesis Overview

We believe Cellebrite is a high-quality vertical market software platform that is being overlooked by investors as a failed SPAC investment trading 50% below its go-public price.

After speaking with numerous customers, competitors, and industry experts, we believe that Cellebrite is both a system of record for end-to-end workflow and one that is mission critical to its customer base. The business demonstrates high 30%s ARR growth with low-single-digit customer churn and ~130% net revenue retention.

Cellebrite is the market leader digital intelligence platform (providing the collection, analysis, and review of digital evidence from electronic devices for cyber-crimes). Cellebrite serves the world’s leading law enforcement agencies and largest private enterprises at each stage of the investigative lifecycle. 90% of Cellebrite’s customers are in the public sector, an end-market we view favorably.

We believe Cellebrite has a durable competitive advantage built on a widely recognized brand, high switching costs and significant barriers to scale for competitors which will enable Cellebrite to sustain its market-leading position.

As a platform company Cellebrite is best positioned to win more of its customer’s wallet share by driving higher attach rates on new and existing products. Historically starved of capital, Cellebrite is now able to invest in solutions which are applicable beyond its current end-user while still leveraging its existing customer base and buyer persona.

Increasing spend within existing customers is the main growth driver for Cellebrite over the next 3-5 years which we believe de-risks our durable growth thesis. Cellebrite is able to earn high returns on incremental capital both organically and inorganically that cannot be replicated by competitors, further strengthening Cellebrite’s MOAT.

Valuation

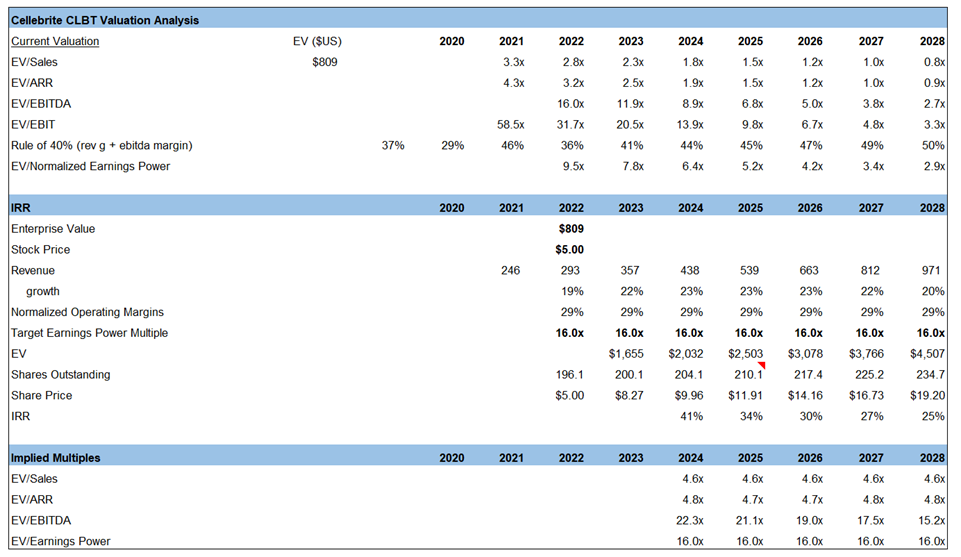

We estimate Cellebrite currently trades at a normalized operating profit of only 7x on our 2023 numbers and will grow top line revenue at a low 20%s CAGR over the next 5 years. Cellebrite has one of the most attractive valuations we have seen in years for a fast-growing tier 1 software business with near zero customer churn and a large embedded upsell opportunity.

Upside Optionality: Following years as an orphaned business, we believe Cellebrite has historically been under-monetized due to underinvesting in growth. At current prices we believe there is free optionality in the business today regarding the potential for continued penetration in the private sector and a large pipeline of highly accretive tuck-in M&A. We believe Cellebrite’s earnings power is higher than its reported economics as we pair Cellebrite’s durable top line growth against a steady-state operating margin that are materially higher than current levels.

Cellebrite’s balance sheet is net cash (17% of market cap) and is not dependent on external capital. Cellebrite use case is not economically sensitive and the business is highly profitable today despite ramping up growth investments in S&M and R&D.

·While we have little confidence in our ability to predict whether Cellebrite’s multiple will expand or contract in the near term, we feel today’s valuation provides an excellent risk-reward over a multi-year time horizon. We see ~10-15% downside from current prices corresponding to a trough multiple of 16x 2023 EV/Reported Operating Income vs our 5-year $17 target price (28% IRR) based on our base case scenario.

Industry Overview

Police, government agencies, and private corporations continue to face increased challenges related to accessing, collecting, and reviewing digital data stored in various locations including electronic devices (phones, computers, email, social media networks etc). In the public sector the work output stemming from digital intelligence is often criminal prosecution or increased processes to counter cyber-terrorism. In the private sector digital intelligence focuses on reducing liability from rogue employees or compromised IP and security. Traditionally, both the public and private sector have relied on manual processes and software point solutions sold via license to collect digital evidence.

We think of digital intelligence as a sub-vertical with the broader security software markets. Third party research puts the overall Security market at >$60 billion with all sub-verticals growing at HSD to LDD CAGRs.

We think of digital forensics software as a natural extension of the workflow overseen and the data produced by software security solutions focused on Network Security & Equipment such as Palo Alto Networks, Zscaler and Fortinet and those focused on Endpoint Security Infrastructure including Crowd Strike, Sentinel One and Carbon Black. The digital forensics process is highly complex with high regulatory hurdles for each geographic region and a constantly evolving list of connected devices which emit digital evidence. Currently the public sector law enforcement industry is in the middle of a shift towards joining the private sector in purchasing cloud-hosted solutions.

Cellebrite estimates a $13.2B TAM for Digital Intelligence in 2023, with approximately half ($6.2B) of revenue sourced from state and local agencies, $5.4B from federal funds, and the remainder ($1.6B) from private sector and enterprise customers. Our hunch is this is overly optimistic on the public sector side of the equation and perhaps pessimistic for the private sector

While we disagree with many software investors who tend to place too heavy an emphasis on non-GAAP/IFRS measures and company-defined metrics like “TAM” our conclusion here is that the demand and overall market for digital intelligence is growing at a double-digit pace and is many multiples beyond the size of Cellebrite’s ~$300m current revenue base.

Background Story of Cellebrite

We believe Cellebrite is a case of a classic “spin-off” story with high returns on capital and a very modest valuation in the vein of our favorite investor, Joel Greenblatt. Cellebrite was founded in Israel in 1999 and sold to Sun Denshi Corporation, a Japan-based conglomerate in 2007. Historically Sun extracted Cellebrite’s excess cash from the business via a series of regular and special dividends leaving Cellebrite financially constrained and unable to pursue a growth strategy.

In 2019, Sun began the process of exiting Cellebrite by bringing in Israeli growth equity firm IGP to fund a~$110 million capital injection into the business in exchange for 24.4% ownership. Highlighting the conflict between IGP, Sun and Cellebrite management, the business continued its series of dividend payments despite IGP’s investment. In 2019, Cellebrite paid out $25 million in the same year it raised $110m from IGP. In 2020, Cellebrite paid a $10m dividend.

In April 2021 it was announced that Cellebrite would merge with TWCT, a SPAC backed by True-Wind Capital, a sponsor with a long history of investing in technology. Cellebrite began trading in August 2021, concurrent with its SPAC merger Cellebrite paid out an additional $100m of dividends to prior owners.

Business Overview

Interconnected devices, cloud storage and exponential growth in data have shifted crime scenes from physical to digital in nature. Digital evidence comes in many forms such as voice, messages, photos, videos, browser history, location data, etc. The users of software such as Cellebrite are digital forensic investigators (law enforcement and government agencies in the public sector) and IT and cyber-security professionals in the private sector. Customers lack the time, scale, and resources to manually compile a wholistic view of these disparate crime scenes and in turn look to software such as Cellebrite for aggregating digital evidence. Cellebrite’s platform allows users to collect, review, analyze, and manage digital data across the investigative lifecycle.

As digital evidence becomes the primary tool utilized by investigative teams to solve open cases, law enforcement agencies view data collection and analysis as paramount to protect communities and prosecute criminals. Most of Cellebrite’s public sector clients have several months of unprocessed backlog for their investigators to manage through as exponential data growth coupled with mostly manual workflow processes results in slow case resolution and reinforces Cellebrite’s offering as mission critical.

Cellebrite is the market leading franchise in digital intelligence and forensics. Cellebrite has ~7,000 customers worldwide with a > 90% win rate on new bids according to management. 70% of customers are government agencies (federal, state, local). Cellebrite’s pub-sec customer base includes >100 North American federal agencies including the FBI, CIA and NSA. Cellebrite is used by 15/15 US cabinet departments and 27/27 EU police forces. At the state and local level, Cellebrite has a presence in all 50 states, with over 2,800 customers including the 20 largest city police departments, and internationally in 13 of the 20 largest European. We believe the public sector software vendors face less disruption risk than their private sector-focused counterparts which is supportive of a higher terminal value and multiple of earnings power, which we define as normalized operating profit.

Despite Cellebrite’s continued progress into the private sector, we believe this growth driver is not being priced in at current levels. Private sector firms also have strong needs for digital intelligence, whether from operating in the legal industry, responding to cybersecurity incidents, or conducting internal and external investigations involving massive data sets. Cellebrite is also used in the private sector by enterprises customers to protect data and information for purposes of internal investigations, eDiscovery, compliance, and cybersecurity. More than 2/3rds of the Fortune 100 are Cellebrite customers which a strong presence in Pharma, Financial Services, Telecom and Technology companies. Cellebrite is targeting a doubling of private sector revenues and 20% of total revenue coming from private sector customers by 2025.

Cellebrite’s pro-forma revenue is >80% recurring, with a ¾ and ¼ split between cloud-hosted SaaS and customer-hosted term-license. The remainder of revenue is split between perpetual license and professional services. Cellebrite offers professional services (~12% of total), including training for effective use of the platform’s features and more advanced investigative consulting. Cellebrite experiences modest seasonality with 45% of revenues in 1H while Q1 is the smallest from a revenue perspective and Q4 is the largest.

MOAT

Mission critical: According to a survey by Cellebrite, 97% of the forensic investigations in 2020 involved a smartphone as a source of evidence. An average investigator conducts 26 mobile device examinations every month (>1 device per working day) with an average examination backlog of three months. Cellphones are only one source of digital evidence-other sources analyzed by Cellebrite products which include computer and IoT devices, over 500k criminal investigations annually utilize Cellebrite’s products. The software acts as a system of record and operating platform that is embedded into public agencies workflow to conduct all digital forensics processes. Cellebrite’s user base cannot do its job without it leading to high switching costs.

Sticky Customer Base: Once Cellebrite is installed the switching costs are considerable with only 1-2% annual churn. Cellebrite’s products are highly integrated into the workflow process of digital forensics investigators and aids them from the start of the initial investigation through to the case being submitted for criminal prosecution. Cellebrite’s brand name and processes ensure the integrity of an investigation is recognized by criminal and judicial courts globally. This aids in a higher percentage of successful criminal prosecutions and counter terrorism initiatives for Cellebrite’s public sector customers relative to less recognized competitors and further highlights both its mission critical nature and its use case as a system of record. In addition the Digital Intelligence suite of products accelerates time to evidence by 30x, leading to faster case solving rates while enabling deeper agency collaboration ( i.e. The FBI can use the platform to identify evidence across different investigations).

Product Innovation/Barriers to Scale: We believe Cellebrite’s MOAT benefits from an R&D scale advantage vs smaller competitors. As an Israeli based business, Cellebrite can source elite talent from the Israeli army’s cyber security innovation team, one of the most advanced in the world. We have spoken with several former & current employees as well as customers who corroborated our view around Cellebrite’s technology and human capital advantage for the company. In Israel, Cellebrite has recently moved its innovation centre from Petah Tikva to Tel Aviv to be better positioned to attract engineering talent which we view as increasingly important in the current hiring environment. Cellebrite has >300 employees working in R&D and we believe has 3-4x more engineers than its next largest competitor Magnet Forensics. On a TTM basis Cellebrite has spent almost as much on R&D ($70m USD) as Magnet has in revenue ($75m). We feel that Cellebrite’s scale of R&D investment leads to two separate MOAT drivers for the business, offensive and defensive.

Defensive: Digital forensics is a fast-moving industry from a product perspective. The data and evidence produced via the use of new applications is accelerating while Apple & others enhance the encryption of their devices and operating systems. This requires frequent software updates being pushed to customers to stay at the forefront of industry innovation. Both Cellebrite and its competitors need to continuously invest in R&D to stay ahead of the curve which requires significant capital and technical expertise that sub-scale competitors and point solutions lack. We think of these investments as “maintenance capex” for Cellebrite.

Offensive: Cellebrite’s continued and accelerating product innovation requires scale and is a key driver of our durable growth thesis as Cellebrite successfully add on products & services. We think of these investments as “growth capex”. Cellebrite has a dollar-based net retention of ~130% highlighting the embedded upsell opportunity within its customer base. Our research has uncovered several cases of customers (a recent example being Singapore’s Ministry of Home Affairs) where Cellebrite’s ARR has increased 5-6x over 3-5 years due to successful penetration of its DI platform.

In addition to a larger R&D budget for scaled-players, Professional Services is a differentiating factor within digital intelligence software. Professional Services are generally done inhouse and not via channel partners, Cellebrite’s scale affords it a larger ProServ team and higher touch with a customer base that is often undermanned and overworked, allowing for increased up-sell capability and a well-established land and expand sales motion to drive DBNR.

Selling to Existing Customers: As highlighted above, Cellebrite’s scale allows it to win in the market due a combination of faster product innovation and an established brand name within its customer base, Cellebrite also benefits from increased customer budget spend. As cloud-hosted workloads and interconnected devices grow, the complexity and need for expanded depth and breadth for digital forensics solutions grows alongside it. Our conversations with industry consultants suggest that most law enforcement software budgets are growing in the low-to-mid-teens year over year. Cellebrite stands to benefit from both same store and new store sales within its existing public sector customers. As the market leader we feel Cellebrite is best positioned to sell new products and modules to its current user base while also selling its suite into new user populations within existing logos.

Hiring in law enforcement is unable to keep pace with the velocity of digital evidence and the resulting increase in digital examiners workloads. Public sector customers are being forced to offload work beyond forensic examiners to colleagues such as forensic analysts and investigators which expands Cellebrite’s potential user base and wallet share within its public sector customers. Further penetration of existing customers should also come at a lower CAC than what is required for net new customers leading to high contribution margins on incremental growth.

The growth from customer expansion has been highly effective in recent years, as the proportion of customers subscribed to four or more solutions has expanded from 6% in 2017 to 50% in 2020. 92 of Cellebrite’s 100 largest customers used 4 or more products in 2021, up 48% from 2020 while Cellebrite reported 83 deals >$500k ACV in 2021 vs 60 the year prior.

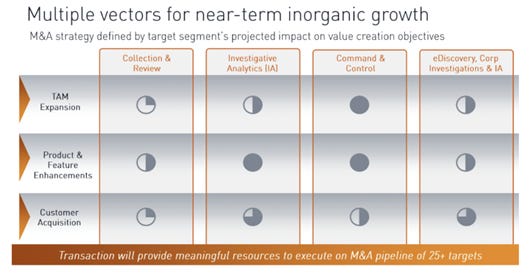

M&A: Largely free of a cost-conscious parent co and with $172m in cash to deploy, Cellebrite is now capable of acquiring additional solutions to expand its product portfolio as the use case for digital forensics continues to expand. Cellebrite made its first ever acquisition in February 2020 followed by a second in October 2021. We believe point solutions within digital forensics face several perpetual headwinds creating an opportunity for highly accretive M&A for Cellebrite. Collection & Review remains the entry into digital forensics and requires a high ongoing cost of R&D investment to stay ahead of technological changes. This makes it difficult to achieve adequate scale to expand into additional offerings while it takes years to build a strong reputation within the public sector. Point solutions also create more opportunities for siloed or lost data that fails to maintain the chain of custody throughout the digital forensics’ workflow. This ultimately leads to lower indictment and close rates, a primary KPI for Cellebrite’s law enforcement customers. The higher operational friction and reduced criminal prosecution makes customers hesitant to use numerous point solutions as a result, preferring to consolidate spend where possible. As the market leader, Cellebrite can acquire and integrate products into Cellebrite’s platform. In leveraging its current R&D capabilities and existing go-to-market motion to cross-sell acquired products, Cellebrite should achieve very attractive returns on capital deployed.

In Q1/20 Cellebrite acquired its first company- Blackbag Technologies to launch its private sector business. The private sector is predominantly focused on computers in C&R with it being the primary endpoint in 70% of investigations opposed to mobile phones representing 90% of endpoints in the public sector. We spoke with the former head of Enterprise (Private Sector) Sales at Cellebrite and he confirmed that Cellebrite had gone from $0 in enterprise revenue in 2019 to ~$25m at YE21 and believed Cellebrite would exit 2022 at ~$35m almost exclusively due to Blackbag.

Assuming 90% of enterprise revenue is from Blackbag and margins slightly below competitor Magnet Forensics’ private sector business, we calculate a ~2 year payback period for Cellebrite on its initial acquisition.

In Q4/21 Cellebrite closed the acquisition of Digital Clues for ~$20m. Digital Clues is an open-source intelligence platform which capitalizes on the trend of law enforcement now using digital forensics earlier in the investigative lifecycle and prior to the commencement of an official criminal investigation. By integrating Digital Clues with Pathfinder, Cellebrite’s analytics product, management believes there is a huge cross selling opportunity to materially increase the value proposition offered by Digital Clues. This thesis was corroborated with a subsequent $10m SaaS contract win, which was the largest SaaS win in the company’s history. The customer was a new logo (public sector) and Cellebrite leveraged Digital Clues open-source platform (specifically for deep dive of web data at the onset of the investigation) to replace an existing solution. Going forward, we expect Cellebrite to cross sell its existing DI suite of products to this new logo. We spoke with competitor Magnet Forensics recently and management noted this capability is becoming more and more important in driving efficiency in the investigative lifecycle and will look to gain this expertise. This gives us confidence Cellebrite has a first movers advantage and continues to be leading edge in its product expansion & development. We anticipate a similar payback for Digital Clues as we saw for Blackbag in the ~2 year range.

We believe the digital intelligence industry has many siloed point solutions. Outside of the core forensics basket we seen ample opportunity for Cellebrite to extend deeper within its core products as well as horizontally. Notably the e-discovery market which operates in an adjacent vertical to digital forensics by using tools deployed in both the public and private sector appears to be highly synergistic

Having historically operated as a capital constrained business, Cellebrite SPAC transaction allowed it to raise capital for M&A for the first time. Cellebrite has over 25 targets M&A already identified and has significant capacity with $172m in net cash and a debt free balance sheet.

Government/Public Sector Focused: Having owned and/or done work on businesses such as Constellation Software, Motorola Solutions and Tyler Technologies we are well versed in the attractive MOATs frequently associated with government software. Barriers to scale in public sector software are significant as its difficult to land an early cohort of reference customers and gain initial traction, but success begets success for established market leaders. We believe Cellebrite benefits from the non-competitive dynamic amongst government agencies which leads to existing customers becoming ambassadors via word-of-mouth references for new customers, leading to additional market share gains at a lower CAC. Law enforcement wants the best product with the most functionality above all else and Cellebrite is the clear market leader today. Generally, the competitive positioning within government software is hard for private sector focused software companies to challenge and the TAM is insufficient for meaningful venture capital investment, leading to a sustainable and defensible market position for leading technology platforms and higher terminal value for the business.

Brand Name within Digital Intelligence: Established and recognized brands such as Cellebrite possess pricing power. Our research indicates that digital forensics software is not particularly price sensitive as overall law enforcement budgets are growing globally and have a higher allocation to software solutions annually due to high ROI and lack of available police staff. Digital forensics software is selected based on key characteristics such as: How user friendly and intuitive is the software? What sources of technology (iOS, Android, Windows etc) is the software compatible with? What data types does the software recognize (text, video, speech, photo etc)? After all these considerations, pricing and the pricing model is then discussed. During our research we often heard of Cellebrite’s name being synonymous with digital intelligence with Cellebrite’s digital evidence accepted as admissible evidence in judicial courts around the world and frequently used and cited in high profile criminal cases. Cellebrite’s ability to successfully aid in the prosecution of drug trafficking cases is so strong that federal government funding programs such as HIDTA (High Intensity Drug Trafficking Areas) provide dedicated funding to local law enforcement agencies solely for the purchase of Cellebrite products

Products

Products Overview

Cellebrite's Digital Intelligence platform consists of products across three functional areas of an investigative process: (1) Collection & Review (2) Investigative Analytics (Analyze) and (3) Management Solutions (Manage). Cellebrite lands new customers through its Collect & Review, primarily UFED, before expanding into additional DI solutions.

Collection & Review: Collect & Review products make up the majority of Cellebrite's revenue and installed base today. UFED (Universal Forensics Extraction Device) is the flagship product and is used to decrypt pattern and PIN locks on Android and iOS devices. UFED has over 42,000 users in 140 countries. Collect & Review products enables extraction of data from digital sources, including smartphones, tablets and computers, and decodes the device to be readable for investigators. Growth in Collect & Review solutions will be driven by cross-sell and upsell of Premium SKUs which expand on the capability of UFED allowing police departments to gain access to data located within the most secure mobile devices. Cellebrite most notable premium product is Premium Enterprise (released July 2021).

Prior to the release of Premium Enterprise, Cellebrite had required that Premium Licenses be installed on a dedicated endpoint with licenses priced per endpoint. The high cost per license and physical endpoint requirement created deployment/accessibility limitations for users located outside of the forensic lab. In response, Premium Enterprise is delivered via a client server architecture on the customers’ network. This democratizes access to Premium and provides all of Cellebrite’s UFED customers to connect existing UFEDs to Premium's advanced capabilities. By selling enterprise-wide access, Cellebrite’s current primary product (UFED) can extend beyond its primary end user (digital forensics investigators). Premium Enterprise allows collaboration across multiple teams and individuals in large and geographically distributed public safety customer pools, lowering technical barriers as well as cost. By pricing Premium at the enterprise level, Cellebrite dramatically cuts the price on a per unit basis while being accretive to total contract value.

Based on our best estimates we believe that for Cellebrite’s largest customers with >200 UFEDs, the conversion is a >30% TCV uplift as customers shift from perpetual licenses for UFED and Premium and over to subscriptions for Premium Enterprise. While it’s not feasible for the Cellebrite’s entire UFED base to convert, especially with smaller customers, we believe Premium Enterprise is accretive to Cellebrite over the length of the contract and increases the ability for additional upsell of Cellebrite’s products to new users within existing customers, helping to provide visibility for the durability of Cellebrite’s growth within its current install base.

Investigative Analytics: Cellebrite’s Investigative Analytics solutions use AI & ML to help investigative teams bring together multiple sources of data to analyze and generate insights. Pathfinder is Cellebrite’s flagship analytics product, which automates data analysis starting from the ingestion step. Pathfinder’s data begins with data ingestion with AI/ML running overtop to provide data insights into the uploaded set of evidence. Growth in Analyze will be driven by cross-selling Pathfinder to the Collect & Review installed base, as well as to new buying centers within existing customers who have landed on the platform via Premium Enterprise.

Management Solutions: Cellebrite’s management solutions aid investigative workflows by enabling communications and collaboration across teams, while controlling access and permissions. Manage solutions provide a centralized platform to manage the investigation workflow across functions more efficiently, breaking down silos and enabling effective collaboration.

Unit Economics

Cellebrite is a business with ~35% ARR growth, ~130% dollar-based net retention, >80% gross margins and low-to-mid teens operating margins by 2023 making it a rule 40+ company. The business is cash generative today despite growth investments.

SaaS Transition

Cellebrite’s revenue is split between perpetual license revenue and subscription revenue which is split between SaaS and term license. For Cellebrite customers that self-host the software but purchase it via subscription, a portion of the subscription revenue is recognized upfront (~40%) under ASC 606 revenue recognition accounting rules. That upfront portion of the subscription is what is shown as term-license.

Cellebrite’s SaaS transition began rolling out in mid-2019 and should be largely complete by mid-2023, we believe is supportive of a higher terminal value for the business. We believe this transition leads to higher customer lifetime value and improved unit economics and improved revenue visibility as ARR growth becomes a better proxy for revenue growth. The hosting change is being adopted by Cellebrite’s competitors as well.

Cellebrite recognizes subscription revenue over the term of the contract, while term license is the portion that is recognized upfront. SaaS revenue is recognized equally over the contract life. A customer converting from perpetual license revenue (100% annual rev rec) to Term Revenue (~40% year 1 revenue) or Subscription Revenue (TCV* 1/n years of contract length) is dilutive to near term revenue and explains the current divergence between Cellebrite’s revenue and ARR growth and growth in ARR vs DBNR. ARR normalizes for duration and the mix of contract types. Cellebrite defines ARR as term-based subscription licenses and ongoing maintenance revenue annualized by multiplying recurring revenue of the last month of the period by 12.

According to our math we estimate that an average Term-License contract has ~20% higher value as compared to a Perpetual-License contract during the same five-year term.

Cloud enhances Cellebrite’s value proposition to its customers. Cloud architecture allows for software to ship more rapidly and frequently with updates passed on to Cellebrite’s entire user base, reducing the likelihood of technical debt and increasing the velocity of the flywheel between increased customer utilization, reduced likelihood of churn and greater ability to upsell new modules.

In some ways Cellebrite has the best of both an on-premise world and a cloud hosted software. Cellebrite heavy public-sector exposure benefits from a captive customer base with an entrenched go-to-market focused on existing logos often associated with on-premise architecture. Cellebrite’s emerging cloud-offerings allows it to drive scale more quickly in product distribution and increasing the buying frequency of newer modules. Higher attach rates on secondary products drive contribution margins and returns on incremental capital that are unlikely to be replicated by smaller competitors offering narrower product sets.

One of our primary concerns as software investors is the creation of shelfware- software that continues to be purchased regularly but suffers from low utilization and customer satisfaction scores. Subscriptions have a long but inevitable lag between a customer becoming dissatisfied and when they ultimately churn off the product. Cellebrite already benefits from extremely high end-user utilization, and we expect this to trend higher as cloud-hosted solutions increase the velocity of the feedback loop between product innovation, customer happiness and increased wallet share expansion.

Cellebrite is currently generating a Sales Efficiency (incremental ARR/ T-1 S&M) of 0.8-0.9x which we believe is in the top quartile of North American software companies and attribute to increasing ACVs and the bulk of Cellebrite’s revenue coming from existing logos. We prefer to avoid the embedded assumptions within LTV/CAC and instead look at payback periods on opex spend for our software investments, both at the S&M line as well as Total CAC which also includes all R&D and G&A spend. From a payback perspective Cellebrite is achieving Gross Profit Dollar breakevens within ~15 months and total cash breakeven on all OPEX spend with ~3 years, both of which we believe are very strong relative to Cellebrite’s overall software peer group and both of which we expect to improve as Cellebrite cross-sells acquired assets and generates operating leverage on overall spend.

Valuation

We value Cellebrite based on our estimates for normalized earnings power (operating income) of the business which normalizes for growth investments being made today. We believe that on a normalized basis Cellebrite should conservatively produce a high 20s% operating margin, below the world’s most profitable software companies due to its smaller scale and higher “maintenance capex” costs for ongoing R&D but largely in like with public-sector focused peers.

Competition

Today Cellebrite is the largest player in the digital forensics space with competitors including publicly traded Magnet Forensics (TSX) and Nuix (ASX) as well as Guidance (owned by OpenText) and private co’s Greyshift and MSAB. Magnet is Cellebrite’s primary competitor with a strong product offering and a respected management team. Magnet and Greyshift previously had had a joint co-sell agreement given Magnet’s strength in computer-based forensics supplemented by Greyshift’s strength in mobile. We spoke with two sources who confirmed that the partnership has recently disbanded.

Magnet is trading at almost a 100% premium on EV/S and EV/ARR basis. Magnet has greater exposure to the private sector which is driving higher margins (gross margin of 94% vs 82% and EBITDA margins in the high-teens vs low-to-mid teens for Cellebrite). On a LTM revenue basis Cellebrite is 3.5x the size of Magnet and 3x on an ARR basis. As of Q1/22 Cellebrite added $51m in incremental ARR vs Magnet reporting $66m in total ARR as of the same time period. Assuming 29% normalized operating margins for both businesses Magnet is trading at 27x based current EV vs Cellebrite at 8x.

Cellebrite's competitors generally fall under two categories: (1) point solutions without end-to-end investigative process support and (2) broader digital intelligence platforms without domain expertise in criminal investigations. While competitors such as Magnet (computer collection and review) and Greyshift (iOS on locked iPhone) and Nuix (ediscovery) offer leading solutions for specific use cases. We believe Greyshift is growing 40-50% y/y and recently raised capital from Thoma Bravo but our working thesis is that Greyshift remains largely a point solution today despite emerging as a market leader in iOS extraction. We feel that Cellebrite has a differentiated position with the most breadth in the industry by offering an end-to-end solution and a leading mobile extraction and investigative analytics products.

Risks

ESG- ESG risk is the largest non-execution risk the company faces. In the past Cellebrite has had legacy customers that act as authoritarian governments and use Cellebrite’s products to the opposition and reduce the standard of humans rights in the country. In these cases, CBLT has an internal system where it monitors the political climate of a country, and if this changes negatively, it stops offering the software to them.

As part of the go public process, Cellebrite has taken several steps to comply with international standards including halted sales to Belarus and Russia in March and the recent formation formed an Ethics & Integrity Committee at the board level which provides more independent review ensuring similar issues do not resurface.

The company also enhanced protocols and internal compliance team that build standards for which parties CBLT can deal with (on top of approved lists). Cellebrite only serves countries on US and UN approved lists.

Public sector financing could limit budget allocation to 3rd party digital intelligence tools within public sector agencies. Overall we believe the spending environment remains healthy but must be monitored on an ongoing basis.

Uptake of Premium product and newer adjacent products are slower than expected, thus lower cross/up-sell opportunities and ASP growth. We believe Cellebrite has pushed its Premium Enterprise product onto the majority of its applicable install base and will face a modest growth headwind as penetration increases.

Small Float: Legacy owner Sun Corp still owns 51% of the business despite only being a passive investor. Cellebrite needs to improve liquidity to attract larger institutional shareholders.

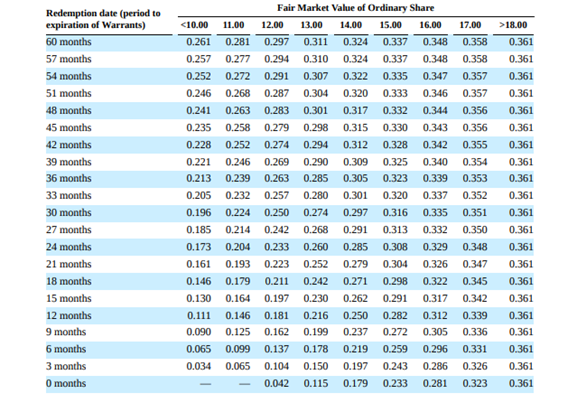

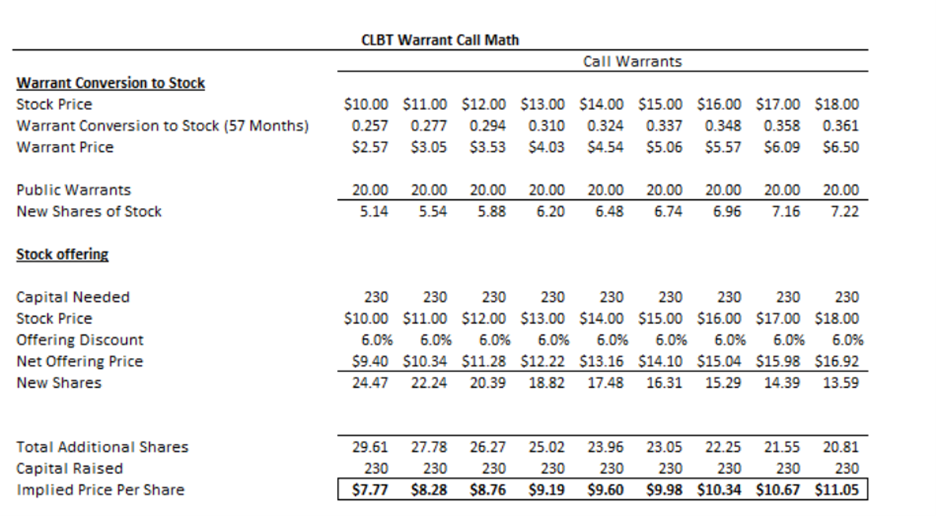

Built in Dilution from SPAC structure: Cellebrite faces dilution from the conversion of existing warrants and the promote paid to its sponsor after reaching certain prices on Cellebrite’s equity. There are 29.67M warrants with an exercise price of $11.50. The warrants have a “grid” for forced stock redemption between $10 - $18 per share. Cellebrite faces meaningful dilution from SPAC sponsor True Wind Capital restricted sponsor shares. Truewind has 22.5M shares that vest at various prices ranging from $12.50 to $30 with meaningful milestones at $12.50, $15, $17.50 and $30 per share.

CLBT will fail. Cellebrite is joke among the forensic community. Unless you are Goverment or law enforcement the products is useless. Cellebrite trying to be a global DI company is a joke they are out of touch. Buying the other worst product "Black Bag" then re labeling it a do all "Forensic" tool it a sad move. Yes they will have their goverment renewal and they will up the price each year but other than that there is no value in this company.

They let go of all their talented sales people are replaced them, the employee turnover is so high because it is still operated like a startup. If Magnet forensic enters the Mobile forensic field Cellebrite is done for. Ask any private sector employee in the forensic world what they think of cellebrite behind close doors and they will laugh.

More and more open source tools are coming out that do the job fine look at aLEAPP that will parse the forensic image and is open source. Cellebrite is a dino in the forensic DI world just waiting to die just like FTK and Encase did. Just a company that gets renewals for revenue and thats what they survive off of.

Thank you for going into the accounting policies and the great article. I have a question where do you tend to start when accessing whether a MOAT exists in a software company? What books would you recommend yourself if you could travel back in time to when you started investing in the space? I thought I might try to exercise posting a comment to get a first mover advantage and get a reply. I have a feeling your posts are going to be flooded with positive comments one day. :) -Smaug