Janus International (JBI)

Summary

Janus International (JBI) is a dominant monopoly business operating in a secular growth end-market trading at 8x our 2024 cash flow estimate.

We see JBI as a highly asymmetrical investment with only modest downside from current levels and model a 4yr IRR of ~30% based on JBI trading at 14x our 2029 FCFPS estimate in 2028. We do not underwrite incremental upside from accretive acquisitions, large share buyback programs or accelerating revenue growth in Janus’ high margin Noke business.

We believe Janus’ SPAC origins and previously limited float have prevented the market from recognizing Janus as a business with a significant MOAT and high returns on incremental capital. Today Janus stock is priced as a deep cyclical that is overearning at the top of the cycle. We strongly disagree and view Janus as an excellent business with numerous compounder characteristics (high insider ownership, limited competition, long term track record, asset lite, high fcf conversion, strong roic) trading at a highly dislocated multiple.

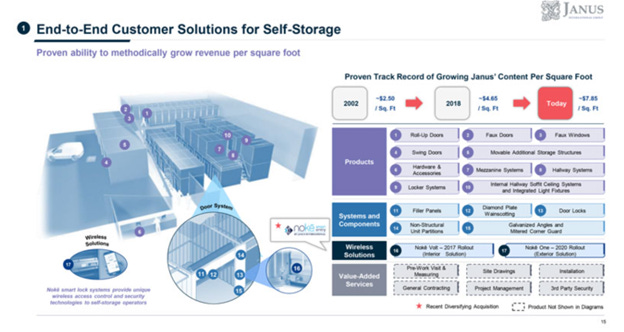

JBI is the #1 products and services provider to the self-storage industry with an estimated 50% market share and 80% within institutional self-storage REITs, the industry’s fastest growing sub-segment. Janus is many multiples the size of its closest competitors.

Janus’ MOAT has attractive characteristics that we typically associate with high quality industrial distributors. Most notably, a flywheel between relative scale which drives greater product availability and wider sku selection, leading to faster inventory turns with more distribution touchpoints, all making for a better customer experience. The result is meaningfully lower all-in costs for customers. Through vertical integration and scale, JBI provides storage operators with assurance regarding the timing of site launch, achieving a speed that is typically three months faster than its competitors from the design phase to the start of the lease up process.

Our scuttlebutt suggests Janus is one of the strongest industrial b2b brands we have come across and is synonymous as the de facto industry standard in the self-storage. Janus' reputation, market share and scale allow it sell at both a higher price AND a lower cost structure that is well beyond what can be replicated by sub-scale competitors. This margin advantage expands as the business grows and Janus leverages its primarily fixed cost base.

Mission critical services: Janus products and services represent a small percentage of its customers’ total costs. Janus is more than a manufacturer and distributor, providing services for site selection and facility design. End-to-end solutions allow for bundled pricing, saving customers time, money, and risk, leading to an extremely sticky customer relationship with high switching costs. We believe there is significant risk for a storage facility to not select Janus.

Janus now has an opportunity to scale its high growth, high margin IoT subscription business (Noke) by cross-selling into its existing customer base. Today Noke is <10% of total revenue but growing at 45-50% y/y vs JBI’s consolidated growth of 6-7%. We believe Noke represents a free call option on industry digitization and is not priced into the stock today.

About

JBI is the largest provider of doors and ancillary products and services to the self-storage industry with an estimated 50% market share and 80% within the institutional REIT segment of self-storage which is ~1/3rd of the market. Janus’ market share has gradually increased over time to the point that it is no longer discussed by management. JBI provides solutions across the entire self-storage industry- spanning from facility planning and design, construction, technology, and the restoration, rebuilding, and replacement (“R3”) of damaged or end-of-life products.

The Company was founded in 2002, originally to provide high quality door systems for the self-storage industry. Over the last 20 years, Janus has consistently expanded its product offerings to the self-storage industry (2/3rd of sales) while also diversifying into the commercial industrial warehousing market (1/3rd). North America is >90% of sales and Products-Services is split 85-15%.

Janus maintains a highly diversified revenue base with its top 10 customers representing ~15% of revenue. NOKE, Janus’ youngest business, is a wireless technology security-as-a-service solution has introduced a highly recurring, high margin cash flow stream that is a MSD percentage of revenue that is scaling quickly.

Janus separates its self-storage revenues into two categories, New Construction and R3 (Restoration, Rebuilding, and Replacement), each representing ~50% of self-storage revenue. We believe the R3 business with demand drivers stemming from a combination of maintenance and growth self-storage capex that operates largely countercyclical to Janus’ new construction busines. From 2019 to 2023E, a period of declining new self-storage construction, we estimate JBI’s New Construction segment revenue will grow at an <2% CAGR compared to R3 revenue at a 24% CAGR.

Commercial

Through a combination of buy and build, Janus has steadily gained share within the commercial market, following a similar path to its consolidation of the self-storage industry over the last 20+ years. Sales in the commercial business are primarily composed of roll-up sheet doors and rolling steel doors.

In 2017 Janus acquired ASTA, which nearly doubled the size of its existing Commercial segment. JBI's continued growth has leveraged additional purchasing power for coil steel, Janus primary cost input, while enhancing factory utilization as products for all three businesses are manufactured on the same production line. This leads to high and growing operating leverage with outsized contribution margins.

The company estimates the commercial warehouse market is growing at a mid-single-digit growth rate, in line with Janus’ storage businesses, due to growth in ecommerce, overall construction spending, replacement of aging infrastructure, and building’s investments in security and energy efficiency. The warehousing industry could also benefit from the continued onshoring of global supply chains that has accelerated post-pandemic. The commercial market has consolidated from ~15 players to ~6, with minimal overlap across the US. We believe JBI’s cost structure is the lowest in the industry, allowing it to sell wholesale while competitors sell direct.

While the commercial business is now lapping significant tailwinds from pandemic-driven ecommerce investments, we view Commercial demand drivers as relatively stable and largely uncorrelated with self-storage demand drivers.

Noke

Janus acquired Noke, a smart lock wireless technology solution, in late December 2018. Noke has now installed its smart lock system on more than 200,000 self-storage doors vs a potential TAM of 22 million self-storage units in the US alone. Janus has sized the opportunity for Noke at over $1bn, this is against a $1.5bn market cap as of December 2023. TAM math is predicated on 55,000 self-storage facilities with an average size of 400 units per facility translating to 22 million doors available for smart lock technology. Janus assumes ~20% long-term penetration of 22mn doors at an estimated ~$250 of available Noke dollar content per door. This translates to a $5.5bn TAM of which 20% is ~$1bn.

Noke locks can generate a significant ROI for customers, boosting the unit economics of a self-storage facility by reducing labor costs and increasing NOI that is valued at the underlying cap rate. Using Noke to eliminate 1 full-time employee at a $50k salary and a 5% underlying cap rate is a $1mn improvement to storage facility valuation!

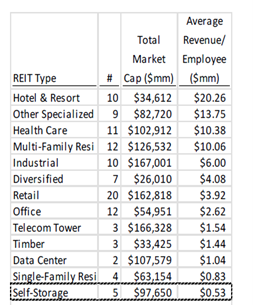

We think labor savings is a big opportunity for self-storage owners which drives the Noke use case. Looking at all U.S. public REITs with market caps greater than $1 billion, we can see that self-storage REITs generate the lowest revenue per employee on average which makes intuitive sense given the nature of self-storage.

Unlike Janus’ other businesses, Noke faces real competition from smart-lock and wireless technology upstarts but much like its core business we believe Janus can leverage its vertical integration as a form of MOAT. Specifically, we think Janus has a significant advantage given its dominant position with well-established relationships throughout the industry. Vertical integration allows Janus the ability to integrate its smart lock into new doors at the time of build. This can drive higher attach rates and better pricing opposed to competing offerings that require an aftermarket installation and an inefficient sales cycle into a highly fragmented industry. Noke expansion is being overseen by a group of executives at both the c-suite and board level who come with extensive experience scaling Honeywell, one of the most successful industrial IoT businesses in recent history.

Technology enablement remains in its infancy for the industry. We believe Noke’s attach rate is the primary KPI in the near term. Noke disclosures have been limited to date but in Q3/23 JBI stated that the business grew 50% y/y and 11% sequentially. We believe Noke will end 2023 with $45-50mn in revenue (4-4.5%) of total revenue. In September 2023, Noke and Extra Space Storage announced an expansion of Noke into an additional 400 ESS facilities, a >50% increase from the previous agreement. Noke revenue is a combination of a smart lock hardware component that attaches to the door of the unit along with a small recurring subscription fee per door to maintain access. We believe hardware has gross margins generally in line with the consolidated business at around 40% while the subscription piece is currently much smaller but has software-like profitability.

MOAT

Janus is the dominant player in its industry with a known brand and product quality that allows Janus to charge product ASPs 5-10% above competitors while maintaining a cost structure that is below peers.

Scale: Janus is the only scaled player in both of its end-markets having acquired their largest competitor in storage; DBCI in August 2021 for $169mn. JBI has also used DBCI’s commercial business as a platform asset, providing an entry point into the commercial door market, a highly synergistic vertical. Janus has subsequentially taken its commercial door market share from LSD to HSD. Entry into commercial leverages additional purchasing power for key COGS inputs such as coil steel and enhanced factory utilization, as both sets of products are manufactured on the same production. This has led to material improvements in consolidated Gross Margins. Gross Margins have gone from 35% in 2019 to 41% on an LTM basis as of Q3/23. We believe Janus can maintain a low 40% Gross Margin over time with incremental Gross Profit dollars having high flow through to cash flow against minimal additional invested capital.

Barriers to Scale: While selling commodity-like products (e.g., steel doors) reduces barriers to entry, Janus has flexed barriers to scale while producing higher quality products at a lower point on the cost curve relative to what can be replicated by competitors. By leveraging its dominant market share, Janus has also demonstrated considerable pricing power. We think Janus’s competitive advantage is aided by leveraging its industry-wide reputation to bundle the cross selling of higher margin value-added services. Janus provides large customers with service for site selection and facility design. Janus is highly integrated with touchpoints at every phase of a project, including facility planning/design, construction, access control and restore, rebuild, replace (R3) of damaged or end-of-life products. Given its relative size, Janus has a robust network of subcontractors that actively seek to partner with Janus while enabling timely installation and service capabilities. Janus has the largest installation network in the industry, working with 135+ partners and covering all 50 states. We believe this dynamic helps explain Janus 80% market share within self-storage facilities owned by institutional REITs as they are the only offering available for regional or national contracts. Janus sells directly to storage facilities with a smaller percentage of sales made via wholesale, primary in its commercial business. Both subcontractors and wholesalers benefit from steady volumes of work that could not be provided by any other player in the industry while Janus’ national warehousing network provides savings on time and transportation costs. In R3, broken doors or units are lost revenue at ~100% contribution margin for Janus’ customers, quick delivery and reliable service is extremely important. As the result of substantial industry consolidation, we believe JBI is >5x the size of its closest competitor and the only company capable of delivering nationwide turnkey solutions. By combining engineering and design plans, doors, hallways systems, remote access technology, Janus offers more depth and breadth than single product competitors are capable of replicating.

“Most of the industry uses Janus doors. Just to set the stage here. Janus is the largest player in the space. They're the McDonald's of self-storage. So they're everywhere. If you go to a trade show, they're the largest operator in the trade show.” - former CTO at Self Storage.

JBI makes better quality products selling at higher prices and gets them to customers faster at lower all-in costs than anyone else. A new entrant can’t be better, faster or cheaper than JBI, highlighting barriers to scale faced by potential competitors.

Pricing power: JBI is widely known to price at a 5-10% premium to smaller competitors due to the qualitative factors mentioned previously. Our view is that pricing power has been further substantiated by Janus successfully passing along substantial COGS and labor cost inflation within its installer network during the pandemic with no loss in market share or structural impact to profitability. Post-pandemic margins have now reset higher as costs normalize while JBI higher ASPs have maintained. In Q3/23 JBI posted its 2nd highest quarterly gross margin (42.5%), which was a 440 basis point improvement from Q3/20 gross margins despite steel prices being up more than 50% over that period.

From a Janus customer:

“We've made multiple deals with them….those doors are holding up well now. It was a better mousetrap that they built. Over the years, they were a threat and they acquired all these other door companies, including US Door and created a monopoly-type situation in the industry, whereas we had no other choice but to buy from Janus and that's when things changed…. Pricing definitely wasn't as competitive anymore”

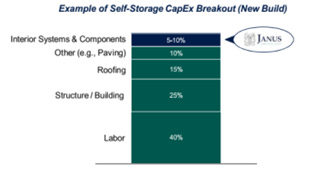

Mission Critical: Janus is a small but crucial piece of a customer’s total cost: representing only 5-10% of total build costs (which does not include land purchase costs) this percentage is greatly reduced on a project NPV basis given the incredibly high NOI margins for self-storage facilities against minimal ongoing capex requirements.

Self-Storage Industry Overview

We think of Janus as a picks and shovels play, offering multiple products and services to the self-storage industry, the most profitable and most attractive vertical with real estate in our view. According to management estimates there are approximately 55,000 self-storage facilities located in the United States.

Industry Demand:

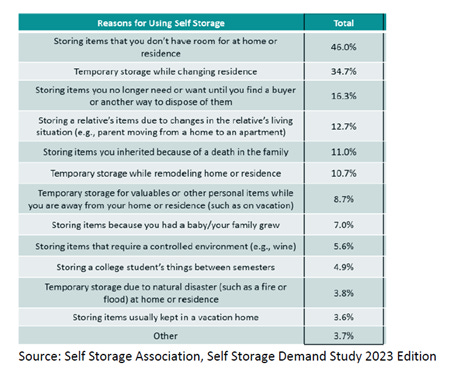

Self-storage has a highly diversified use case which has helped drive gradually increased demand with limited cyclicality over time. Demand is driven by population growth, high housing costs, divorce rates, migration, changing work patterns and inertia. According to the SSA, Self Storage Demand Study 2023 Edition, commercial business demand represents 20-30% of the rented square footage for self-storage which has increased meaningfully over the last ~10 years and will help provide a buffer for SSS comps in a recession relative to the GFC. Our primary work suggests that spreads in average rent for self-storage facilities vs dedicated commercial storage facilities can be as wide as $1.50/sqft vs $9/sqft for commercial making customers less price sensitive and stickier. Commercial use cases help provide a hedge against a period of sustained consumer-related headwinds.

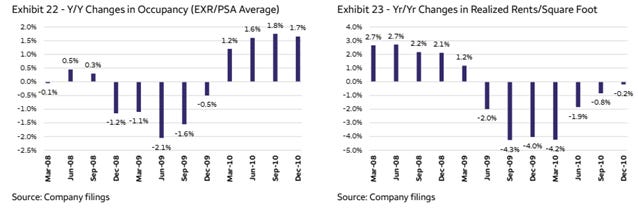

We feel that self-storage even has an element of antifragility inherent in its use case, with storage demand benefiting from periods of chaos or a high degree of change in macro-economic conditions such as economic recessions. During the GFC self-storage significantly outperformed other real estate verticals with large REITs EXR and PSA experiencing only nominal declines in occupancy and rent prices.

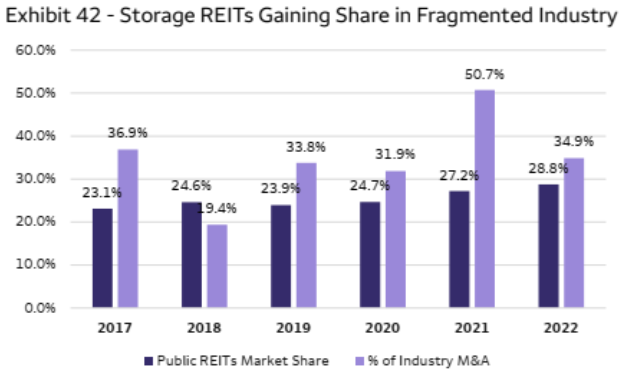

The industry has seen consolidation over time, with institutional capital acquiring smaller local and regional players. This has benefitted Janus which has an estimated 80% market share within institutional self-storage REITS. We think of Janus’ R3 revenue as a derivative of SSNOI growth and ongoing storage industry maintenance capex.

Recall the industry remains tight with occupancy well above its 85% steady state target. Outside of increasing occupancy from ~90% today (touched on under Industry Supply), for facilities to drive SSS growth beyond inflation, we believe that they require facility upgrades to maximize rent per sfqt. Why? The self-storage market remains in a steady state that is reasonably competitive across almost all major markets with ~10% industry vacancy rates. Then factor in a consistent baseline of aging facilities that require ongoing annual maintenance spend, industry estimates put 60% of facilities being over 20 years old and in line for a capital refresh We believe REITs and smaller facility owners alike see this R3-related spend as being done at attractive ROIs. Given the nature of the assets, we believe a period of sizable industry maintenance capex budget cuts could be thought of as delayed opposed to lost, helping to give us additional comfort that Janus’ cyclicality is much more moderate than what is implied by its share price.

Industry Supply:

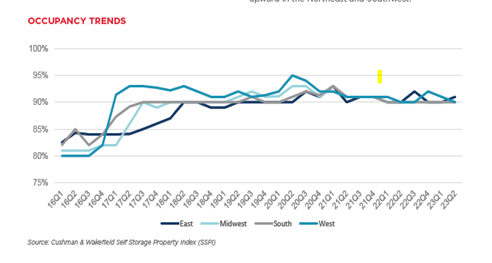

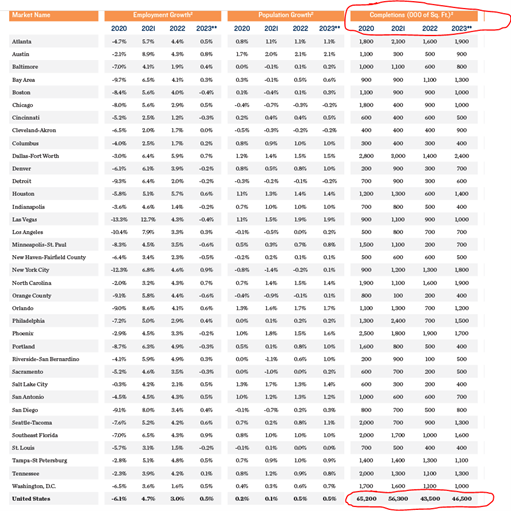

Unsurprisingly, new construction revenue for Janus is driven by changes in industry square footage. Our work suggests that storage supply varies by end-market based on regional and often city-specific supply and demand factors. Our conversations with storage facility operators reiterated that the industry targets a mid 80%s occupancy rate as a baseline standard for a balanced market which would be thought of as a preliminary gauge for new supply being dis/incented to come online. Industry data is fragmented but CWK suggests occupancy has remained stable in the low 90s over 5 years.

Despite increased debt financing costs as a detriment to new supply growth, we believe this is outweighed by several key factors and new supply will continue to come online in line with historical averages at 0.25-0.50% growth annually.

Data on new construction starts is incomplete as it mostly covers only major MSAs and thereby misses a lot of secondary/tertiary market activity. We’ve done our best to triangulate the via industry service providers including Yardi and Marcus Millichap, the later of which has new industry supply down ~30% in 2023 from 2020 while our conversations with investors and industry participants suggested that new supply is down 45-50% from peak growth in 2018/19. We believe this is further triangulated by JBI’s new construction revenue having CAGR'd at <2% from 2019-2023E, a period which includes in-organic growth from M&A. Janu’s new construction revenue has gone from 55% of revenue in 2019 to 32% over the same time period.

To reiterate- our view is that the self-storage industry remains tight with occupancy 5 points above industry targets and new supply growth is already down 30-50% from its peak.

Of course, the elephant in the room is the negative impact of rising rates in a debt-fueled industry. Could new supply take several more step changes down? We can’t argue against that possibility and struggle to quantify the probability. But if this happens it would simply be the continuation of a trend that has already been playing out over the last 5 years and we believe largely built into Janus’ medium term revenue guidance of 4-6% annually.

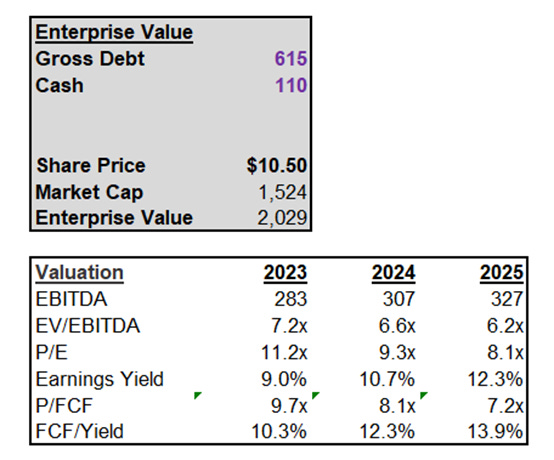

Outside of positive-supply demand factors we believe there are a few additional items that serve to reduce the negative impact of rising rates. Self-storage remains a highly desired asset class and cap rates remain very low, helping to further incentivizing new supply to come online.

Institutional REITs remain net buyers of the asset class and recall that Janus’ business is over indexed towards REITs. In a period of sustained high rates, we see accelerated industry consolidation as industry participants with the lowest cost of capital achieve economic profits unavailable to smaller players. M&A remains healthy per CWK’s most recent industry report:

Additionally, the industry has historically demonstrated a material spread between development yields and cap rates on leased up facilities, with occupancy-stabilized institutional assets trading at much lower cap rates. We believe this is structural with sub-scale assets requiring a higher percentage of NOI to service capex commitments and therefore trading at higher cap rates. We think of this lease-up dynamic as reducing risk for developers by creating a free inherent put option for small regional developers who upon lease up, have a natural acquirer of their asset via a strategic bidder. Scaled institutional acquirers also trade at higher multiples due to their ability to drive growth inorganically and in turn benefit from a multiples re-rate of the acquired assets. As such REITs can therefore justify paying a higher multiple and drive continued M&A activity. M&A dynamics are favorable for the REITs with 3-4 natural buyers against numerous potential sellers.

Janus’ share price suggests that the market is NOT currently underwriting a plausible upside scenario to our baseline view of modest industry growth. We believe there is building momentum around a wider scale rollout of IoT technologies such as a Noke. We see a potential downstream impact of accelerating technology usage leading to an increase in square footage of new storage cohorts coming online. Given the high ROI and positive NOI impact that we’ve previously highlighted, there is a scenario where remote access leads to new storage supply coming online at a faster pace. Labor cost savings following right to the bottom line can change the unit economics for new facilities, particularly in more cost sensitive secondary markets.

In summary as it pertains to Janus, we believe that the self-storage supply-demand equation is stable and hyper localized. Industry consolidation will continue; providing a nice tail wind for Janus’ R3 business and new construction supply is already well below its previously peak of 2018/19 as reflected in Janus’ new construction business. Janus’ commercial business is driven by distinct B2B demand factors largely not present within its 2 self-storage businesses. All 3 business inherently have distinct and dynamic drivers that partially hedge weakness against one another, much like we have currently seen play out with Janus’ revenue growth so far in 2023. At <10x this year’s FCF with modest multi-year guidance targets, we believe Janus’ share price already reflects a particularly bleak macro environment that is much more unlikely than the probability implied today.

Capital Allocation

Janus has been a private equity owned business since at least 2013. Excess capital has historically gone towards acquisitions and servicing high levels of debt, as Janus has rolled up the self-storage door industry since its founding in 2002. Since 2016, Janus has completed nine acquisitions. Notable transactions include); a large expansion into the Commercial segment via ATSA (August 2017); smart lock technology business Noke (December 2018), Betco (March 2019) which expanded its exterior building product offering. Perhaps most importantly, was the M&A of Janus’ primary competitor DBCI (August 2021). Recent capital deployment has been focused on small, tuck-in M&A of international self-storage assets. We think Janus continues to be able to acquire sub-scale companies with lower margins and achieve operating leverage from cost and expense synergies leading to ongoing consolidated margin improvements.

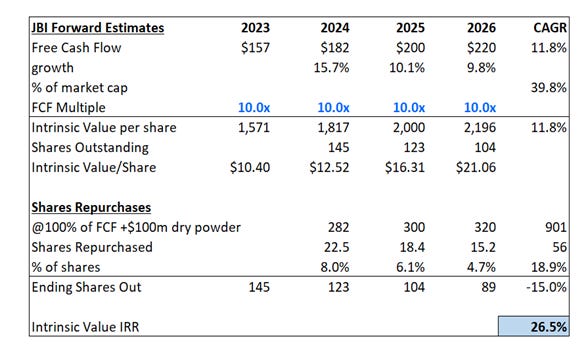

Today JBI is public, well capitalized, and firmly established at the #1 player in the industry. The business does not pay a dividend and as of Q3/23 has repaid $90mn in net debt YTD with leverage now at 1.8x TTM EBITDA, below management’s target of 2-3x. Debt is 100% comprised of JBI’s First Lien Term Loan, maturing in August 2030.

We believe management will continue with smaller, tuck-in M&A at mid-teens returns on capital with recent commentary suggesting valuations have begun to come in.

Having discussed with management and with the stock trading at a double digit FCF yield on THIS YEAR’s numbers, we believe Janus is likely to initiate a material NCIB policy sometime in early 2024, this could also serve to help further reduce Private Equity (Clearlake Capital Partners) ownership in the business from ~15% today.

Since 2017, acquired revenues have contributed ~36% of total incremental revenue. And despite acquiring a material amount of revenue at initial margins well below company gross margins, Janus has still been able to drive consolidated gross margin improvement. In fact, the LTM gross margin as of Q3/23 is ~250 basis points higher than it was in 2018 despite steel the coil steel price index being up 13% and Janus acquisitions being dilutive to initial gross margins (confirm/update).

Most recently we think the company is showing effective capital allocation by announcing that it was increasing capital expenditures in 2023 (by ~$10mm) to build a manufacturing plant in Continental Europe. Janus has a plant in the U.K., but Brexit has made it difficult and costly to sell product from this plant to Continental European customers despite strong demand. Even with the investment, 2023 Capex should be <2% of revenues and we expect this gradually decline as the business scales.

With low leverage, no dividend and only small foreseeable capital outlays, we think it is possible if not likely that Janus becomes a share cannibal, buying back a material percentage of its business.

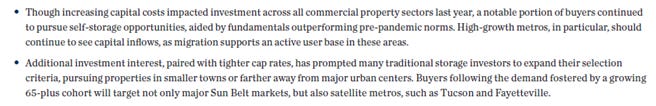

Returns on Incremental Capital

As discussed, JBI has repeatedly flexed pricing power in excess of internal inflation with gross margins having gone from 34% in 2021 to 36% in 2022 to 41.8% year to date. We believe margins can remain in the low 40% over the medium term with upside potential from Noke. Short term dips following periods of rapidly increasing COGS are quickly passed on with a short lag. Incremental Gross Profit has high flow through to cash flow with outsized contribution margins against low capex requirements driving very high returns on incremental capital (CFROIIC, CFROITC).

We are modelling $157mn of FCF for Janus in 2023 against $1.1bn in invested capital for a cash flow return on invested capital (CFROIC) of 14% up from 9% only 4 years ago due to a high 20%s return on total incremental capital and nearly 40% on a tangible capital basis. >70% of Janus’ balance sheet is comprised of goodwill and intangible assets, mostly related to previous acquisitions. Given the nature of these assets and lack of ongoing capital spend required, Janus is currently generating ~$157mn in FCF against only ~$300m in physical assets, for incredible 53% ROITC.

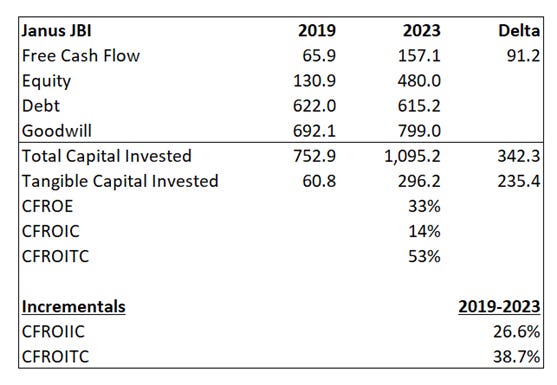

Over the next 3 years we expect returns on incremental capital to inflect even higher with mid-single-digit revenue growth and high contribution margins against small ongoing capital requirements requiring only modest investments in PP&E and working capital.

We believe Janus can generate 40% of its current market cap in free cash flow from 2024-2026. With leveraging surpassing the low end of management’s targeted range, we estimate the business has an additional ~$100mn annually in debt capacity to deploy on share buybacks while maintaining its leverage targets of 2-3x EBITDA. Hypothetically if Janus were to become a ‘share cannibal’ it could generate a high 20s IRR simply by deploying all its free cash flow towards stock repurchases, assuming no multiple expansion on acquired shares.

Management Alignment

Janus market cap is $1.5bn, company insiders own more than $120mn of stock. Janus’ current management has grown the business from nothing to a $200mn FCF business. CEO Ramey Jackon is effectively a founder, having been with Janus since inception in 2002 and CEO since 2005. Both the BoD and C-Suite ave notable Honeywell alumn, including JBI’s CFO and Noke CEO. Janus’ HON alum have scaled various IoT businesses for decades.

Why did they choose to go public through a SPAC? Seems like a business for which an IPO would have been possible.

what's current situation with the company?